DATA ANALYST PORTFOLIO

Project 2

Stock Market Analytics || SQL

💼 Overview

I worked on a project that involved writing SQL queries to extract insights from a financial database combining stock data, social media sentiment, influencer predictions, and user portfolios. The focus was on answering real business questions that could support reporting and investment decisions.

✅ What I Built

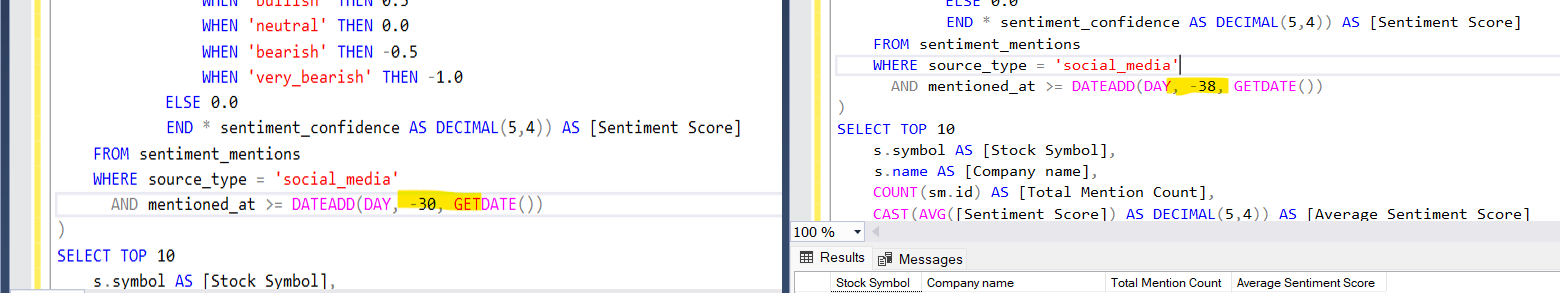

🔟 Top 10 Stocks by Social Media Activity

- Identified the 10 most mentioned stocks on social media in the past 30 days.

- Calculated average sentiment scores using confidence-weighted sentiment categories.

- Tech Used: CTEs, sentiment score mapping, AVG(), COUNT(), JOIN, DATEADD()

- Key Fields: Stock symbol, company name, total mentions, average sentiment.

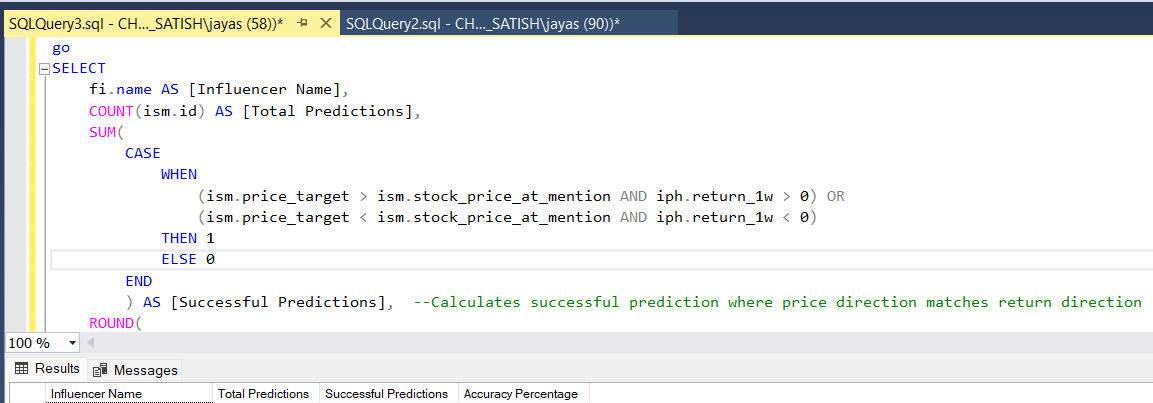

🧠 Influencer Prediction Accuracy

- Measured how accurately influencers predicted stock direction

- Compared price targets with actual 1-week returns.

- Filtered for influencers with at least 10 predictions to ensure meaningful results.

- Tech Used: CASE WHEN, JOIN, HAVING, conditional aggregation

- Key Fields: Influencer name, prediction count, success count, accuracy rate.

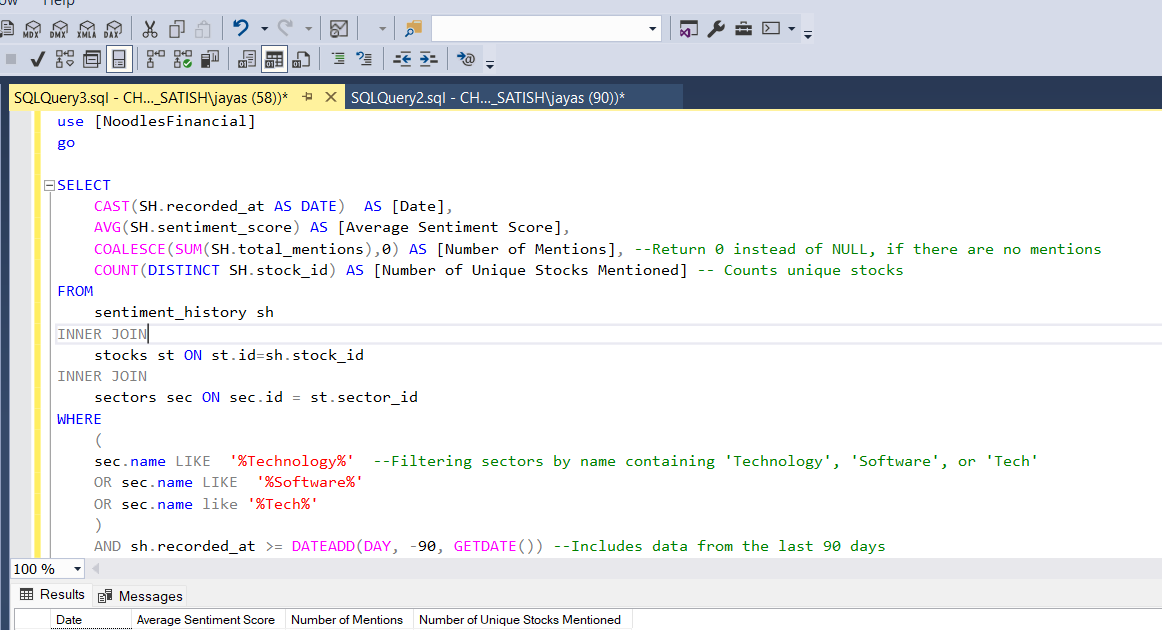

💻 Technology Sector Sentiment Trends

- Analyzed daily sentiment trends for tech-related stocks over the last 90 days.

- Filtered sectors using keywords like 'Technology', 'Software', and 'Tech'.

- Tracked average sentiment, mention volume, and number of unique stocks mentioned.

- Tech Used: String filtering (LIKE), GROUP BY, DATE casting, joins with sector data

- Key Fields: Date, average sentiment score, mentions, unique stocks.

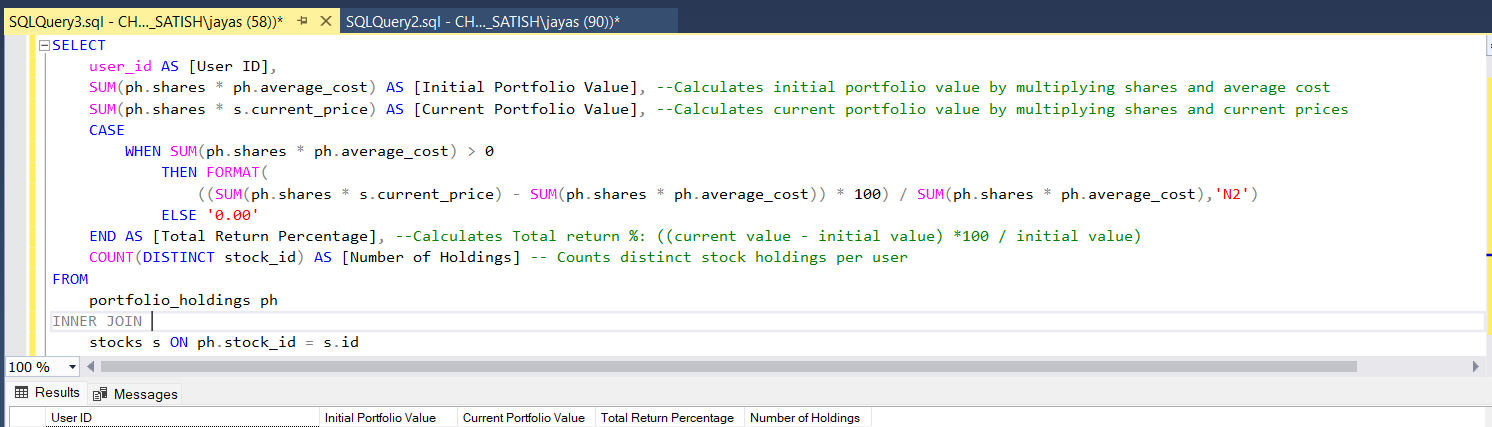

👥 User Portfolio Performance Analysis

- Calculated initial vs. current portfolio value for each user.

- Derived return percentages and counted number of active holdings.

- Included only users with at least one current stock position.

- Tech Used: COALESCE, CASE, aggregation, joins with stock price, HAVING

- Key Fields: User ID, initial and current portfolio value, return %, number of holdings.

📈 Sentiment vs. Price Movement Correlation

- Used window functions to derive next day sentiment score.

- Explored the link between sentiment scores and next-day stock price changes.

- Focused on stocks with at least 30 days of valid data to ensure reliability.

- Tech Used: CTEs, window functions (LEAD()), percentage change logic, filtering by trading days

- Key Fields: Stock symbol, average sentiment score, average next-day price change %, days analyzed.

♻️ Reusable Views

To make reporting easier, I also created reusable views including:

- vw_influencer_prediction_accuracy: Summarizes influencer accuracy based on 1-week stock return direction.

- vw_technology_sector_sentiment_trends: Tracks daily sentiment trends for technology-related stocks.

- vw_user_portfolio_performance_analysis: Calculates portfolio value, return %, and holdings per user.

🛠️ Tools & Skills

- SQL Server, Joins & Aggregation, Window Functions, Conditional Logic, Financial Metrics, Data Validation

See Code here!